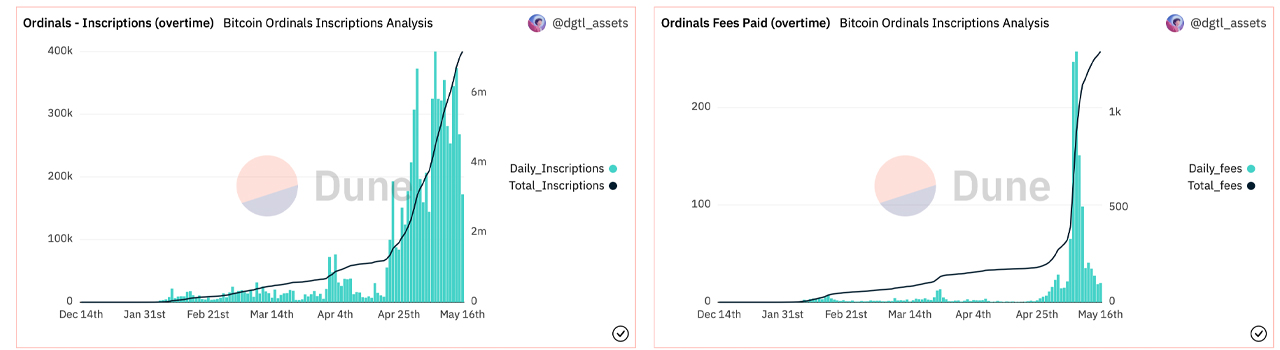

On May 15, 2023, the number of Ordinal inscriptions surpassed the 7 million mark and as of 9:00 a.m. Eastern Time on Tuesday morning, 7,204,882 Ordinal inscriptions have been added to the Bitcoin blockchain. Miners have collected 1,324 bitcoin in fees by confirming inscription transactions which equate to roughly $35.86 million in added onchain fees.

Bitcoin’s Inscription Frenzy: Over 7 Million Ordinal Inscriptions and Counting

The unstoppable momentum of Bitcoin’s Ordinal inscriptions continues to defy detractors, surging past several milestones. With over 7 million inscriptions now firmly embedded in the blockchain, any skepticism toward demand surrounding this trend is being shattered. Today, on May 16, 2023, the tally stands at 7,204,882 inscriptions since the inaugural one occurred on December 16, 2022.

The world of inscriptions experienced a significant acceleration on April 21, 2023, when the count stood at a mere 1.24 million. In just 25 days since then, the number of Ordinal inscriptions has skyrocketed by over 480%, signaling an astonishing surge. Notably, May 7, 2023, emerged as the pinnacle of this inscription frenzy, with a record-breaking influx of inscriptions. It was on this day that Bitcoin’s mempool found itself congested with an overwhelming 500,000 unconfirmed transactions, a testament to the overwhelming demand and activity in the system.

30-Day Sales Stats Show Bitcoin’s Ordinal Inscriptions Have Bolstered NFT Market

Bitcoin miners have been handsomely rewarded for their role in processing inscription transactions, receiving 1,324 bitcoins (BTC) valued at $35.86 million. Notably, the pinnacle of these fees was witnessed on May 7, coinciding with the day when Bitcoin’s network fees surpassed the 6.25 BTC block subsidy. Intriguingly, the majority of Ordinal inscriptions take the form of plain text rather than JPEG images, with an overwhelming count of 6,402,199 inscriptions embracing the plain text format.

The realm of selling NFT collections has proven profitable for Ordinal inscriptions, amassing $93 million in sales over the past 30 days. As a result, Bitcoin has ascended to become the second-largest blockchain in terms of NFT sales this month, according to 30-day statistics from cryptoslam.io. Notably, the market has recorded sales from popular Ordinal collections such as Pixel Pepes, Sub100k, Bitcoin Frogs, Space Pepes, Bitcoin Punks, and Sub10k. Out of the six highest-priced NFTs sold this month, five have emerged from the fertile grounds of the Bitcoin blockchain’s Ordinal inscribing technology.

What are your thoughts on Bitcoin’s surge in Ordinal inscriptions and its impact on the NFT market? Share your insights and opinions in the comments section below.

from Bitcoin News https://ift.tt/biU7qI8

Comments

Post a Comment