About 40% of 153 African banks surveyed by the latest African Banker annual report said they regard “fintechs and telcos as high threats,” while 69% see artificial intelligence as the “most important technology shaping the industry in the near future.” According to the survey findings, only 28% of survey respondents confirmed that their respective institutions are spending more than $3 million “on digital transformation and innovation” annually.

Fintechs Have Helped to Revolutionize Africa’s Banking Industry

According to the latest African Banker annual report, of the 153 banks that were surveyed about 40% said they “regard fintechs and telcos as high threats.” The survey study also found that some 69% of the surveyed banks view artificial intelligence (AI) as the “most important technology shaping the industry in the near future.” A year earlier, about 74% of the banks had identified cybersecurity “as one of the most important trends” for the industry’s future.

As acknowledged in the press statement issued by the African Banker magazine, fintechs along with digital-first banks, mobile money, and agency banking have revolutionized the continent’s banking industry. In the case of fintechs, their impact on the continent’s banking industry is evidenced by their share of the total capital raised by African tech startups in 2022.

In a report published in February, Bitcoin.com News revealed that fintechs on the continent had raised $1.45 billion in 2022. This figure was nearly 40% more than the $1.04 billion which was raised by fintechs in 2021. Meanwhile, concerning the proportion of fintechs to all tech startups, the African Banker annual report, citing management consultants McKinsey, puts their number at just under half of the 5,200 firms.

Banks Understand Importance of Technology, but Few Building Related Strategies

Although many of the banks are said to understand the importance of digital technology, the annual report said only a few seem to be building strategies around this.

“It is clear that most African banks understand the importance of the technology, with just 4% considering it just one element among many or not at all important. Yet with just 51% regarding it as the most important factor, it is also apparent that many banks are not building their overall strategies around digital technology,” the annual report noted.

To back this observation, the report points to findings which show that only 28% of survey respondents acknowledged that their respective institutions are spending more than $3 million a year “on digital transformation and innovation.”

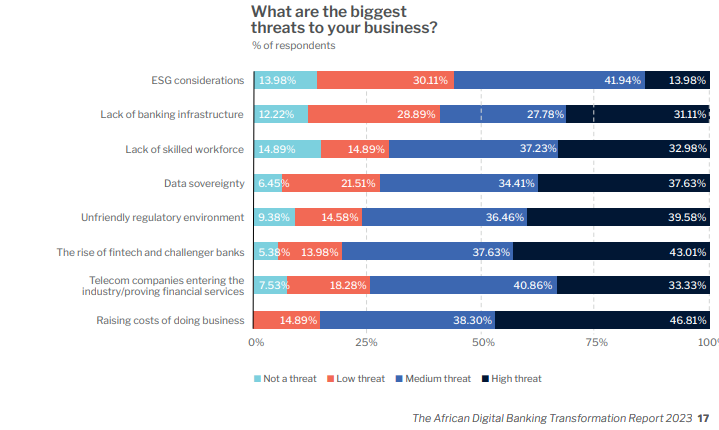

Besides having to contend with fintechs and telcos, surveyed African banks also identified unfriendly regulatory environments, data sovereignty, and a lack of skilled workers as the other “high threats.”

Register your email here to get a weekly update on African news sent to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.

from Bitcoin News https://ift.tt/6vXG82w

Comments

Post a Comment