Following the introduction of Ordinal inscriptions, BRC20 tokens, and Stamps on the Bitcoin blockchain, the community has seen the debut of a new digital object technology named Atomicals.

Meet Atomicals: The Latest Data-Embedding Technology on the Bitcoin Blockchain

Since the close of 2022, Bitcoin has seen the rollout of several technologies that use data embedding schemes to craft new coins, non-fungible tokens, and name service domains. One of the standout technologies today is the Ordinal inscriptions on Bitcoin.

To date, about 34.55 million Ordinal inscriptions are linked to the distributed ledger. Ordinals have also produced tens of thousands of new coins called BRC20s. Additionally, there are Bitcoin Stamps, a data embedding method that also taps into the Counterparty blockchain network. So far, about 74,640 Stamps have been minted on the chain.

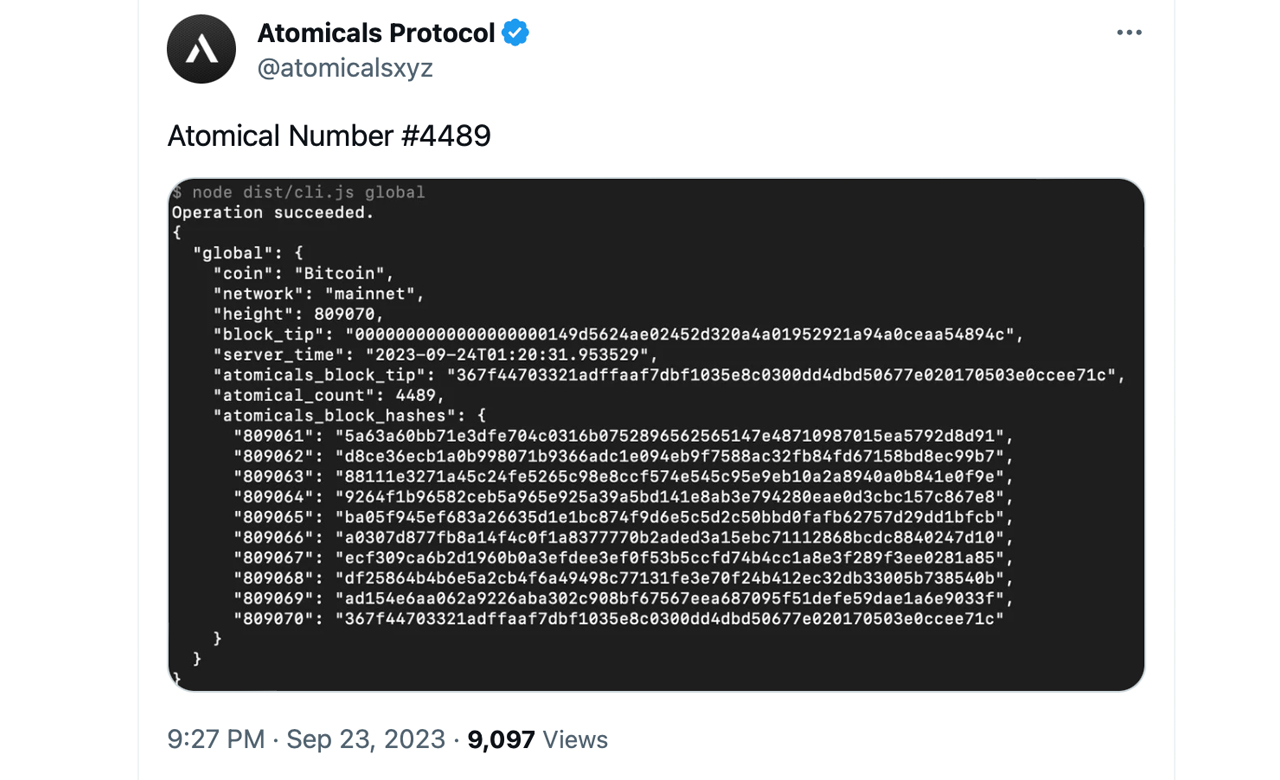

A recent addition to this lineup is a data-embedding technology named Atomicals, which can produce coins dubbed ARC20 tokens. The Atomicals technology can also be harnessed to mint NFTs, and it introduces a name service domain structure called Realms.

According to the creators, an Atomical, colloquially known as an “atom,” changes how users handle the creation, transfer, and evolution of digital objects on the Bitcoin blockchain. Atomical developers believe that at its core, it’s a dynamic chain of digital ownership, shaped by a set of clear rules.

Ordinals and Atomicals share key similarities; both empower individuals to innovate and create with Bitcoin. On the distinction front, Atomicals rely on Electrumx as an indexer, whereas Ordinals turn to the Ord indexer. Atomicals’ documentation highlights that the technology features a distinct class of container NFTs, simplifying the process of defining collections.

The Atomicals Guidebook underscores that Atomicals are defined as “digital objects,” Ordinals as “digital artifacts,” and Ethereum’s ERC721s as “digital collectibles.” Data from Dune Analytics reveals that since block height 808,513, approximately 69,847 Atomical digital object transactions have been confirmed on Bitcoin’s distributed ledger.

Further data points out that transactions involving Atomicals have contributed 5.772 BTC or $153,611 to miners since the technology’s introduction. The Realms name service also features a notable list of names like “timechain,” “volt,” “flex,” “collect,” “anon” and “idol,” among others.

Only time will reveal whether Atomicals endure and garner demand, and if the technology gains acceptance in the wider community. While Ordinal inscriptions and traditional financial inscription enthusiasts have butted heads, a fresh market for utilizing block space on Bitcoin has sprung up, regardless of differing opinions.

What do you think about the newly introduced Atomicals tech? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/XdG0FVe

Comments

Post a Comment