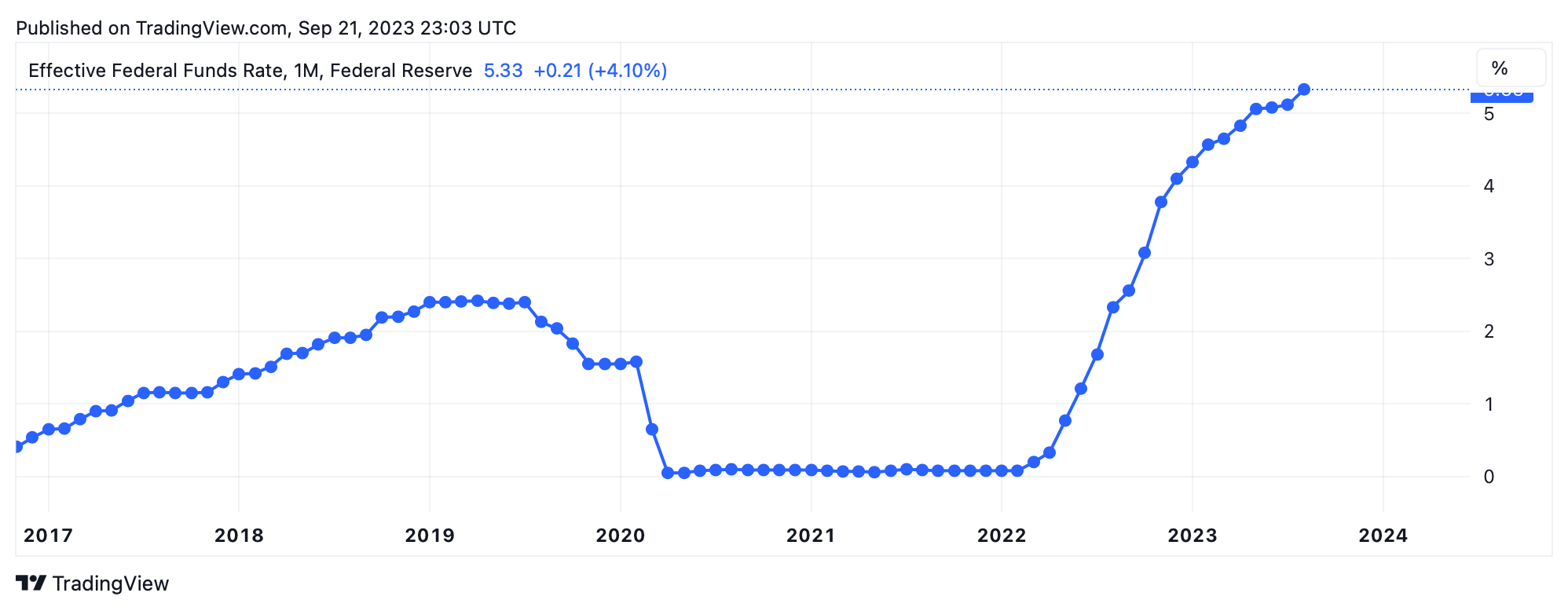

Based on the U.S. Federal Reserve’s forecasts, it appears that the central bank is poised to enact an additional hike to the federal funds rate by the end of 2023. The news comes in the wake of the Federal Reserve’s decision to leave the interest rate unchanged during its recent gathering of the Federal Open Market Committee (FOMC). Jerome Powell, the chairman of the Federal Reserve, emphasized this week that the central bank’s strategy entails supporting “the policy rate and await further data.” He underlined the importance of maintaining a “restrictive policy” to achieve the desired goal of curbing inflation.

Powell: A Soft Landing Is What ‘We’ve Been Trying to Achieve for All This Time’

During the recent FOMC gathering, the U.S. central bank opted to maintain the status quo on interest rates. The FOMC’s official statement underlined the “sound and resilient” nature of the U.S. banking system, even in the face of tightened credit conditions affecting businesses and households nationwide. The central bank remarked, “Recent indicators suggest that economic activity has been expanding at a solid pace.”

Following the meeting, Jerome Powell, the Federal Reserve chairman, engaged with the media in a press conference to discuss the state of the U.S. economy. In a dialogue with numerous reporters representing various news outlets, Powell articulated his long-held belief in the feasibility of a “soft landing,” a conviction he has held since the emergence of inflation pressures. Powell further emphasized:

A soft landing is a primary objective. And I did not say otherwise. I mean, that’s what we’ve been trying to achieve for all this time. The real point, though, is the worst thing we can do is to fail to restore price stability, because the record is clear on that.

The U.S. central bank has unveiled its forward-looking projections, and Federal Reserve members have underscored the likelihood of the federal funds rate climbing to 5.6% by year-end. While approximately seven Fed officials voiced reservations about this rate hike, a consensus of twelve members is firmly in favor. Currently, the CME Fedwatch tool indicates that investors are foreseeing this increase materializing in December.

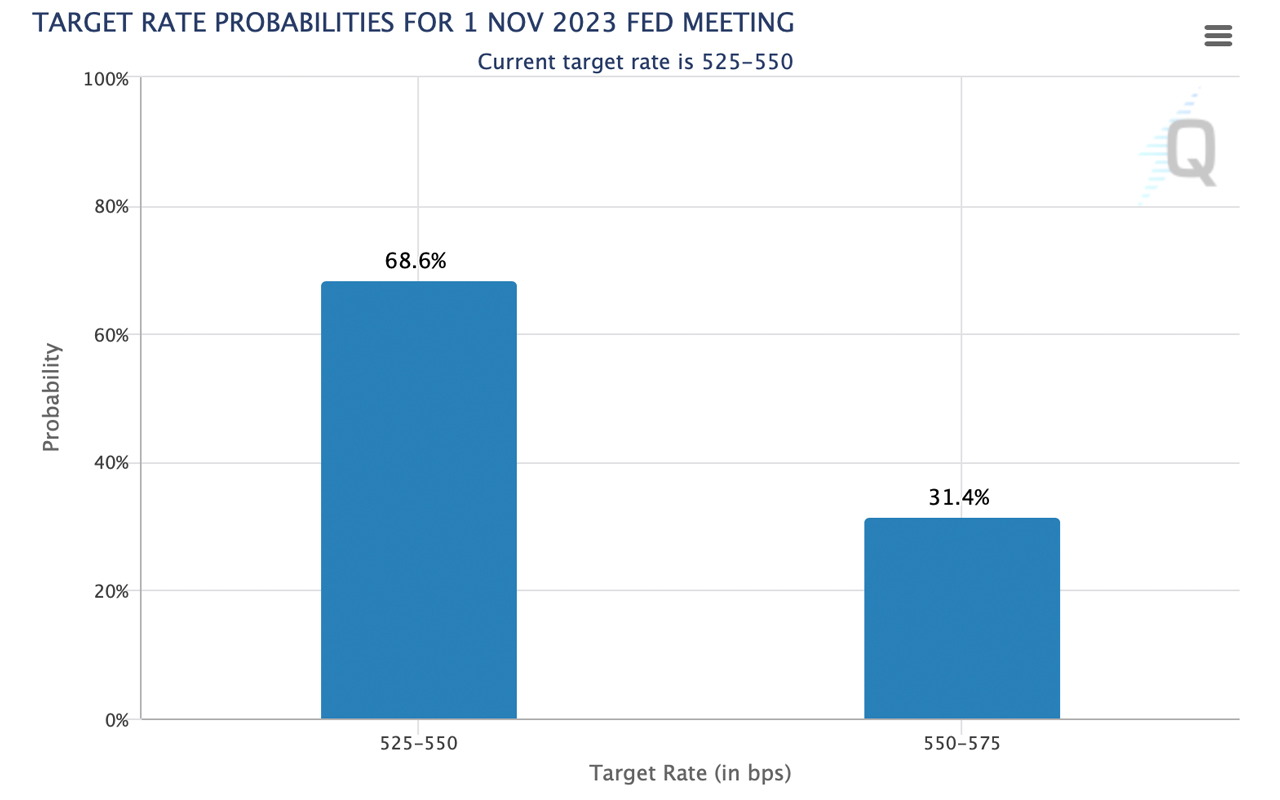

As of September 21, 2023, the Fedwatch tool registers a 68.6% probability of the rate holding steady, with a 31.4% chance of an upward adjustment at the forthcoming FOMC meeting in November. Two more Fed gatherings are scheduled for this year. Furthermore, following the Federal Reserve’s deliberations, the Bank of England and the Swiss National Bank have also elected to maintain the status quo on their interest rates. On Thursday, all four primary U.S. indices closed in negative territory, while the cryptocurrency market experienced a 1.4% dip over the course of 24 hours.

In the realm of precious metals, such as gold and silver, relative stability has prevailed following the FOMC meeting. Concurrently, lending rates in the United States have been facing substantial pressure, as reported by The Kobeissi Letter on Thursday, which noted that the “average interest rate on a 30-year mortgage rises to 7.59%, its highest since December 2000.”

“With interest rate cuts now no longer expected until September 2024, it is likely we see 8% mortgages soon,” Kobeissi posted to the social media platform X. “On top of the Fed holding rates higher for longer, US deficit spending is so large that $1.9 trillion in bonds are being issued over 2 quarters. This is flooding bond markets with supply and driving interest rates even higher. Currently, the median payment on a new home is nearing a record $2,900/month. What’s the long-term plan here?”

What do you think about the Fed raising the federal funds rate one more time before the end of 2023? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/xEmWMJs

Comments

Post a Comment