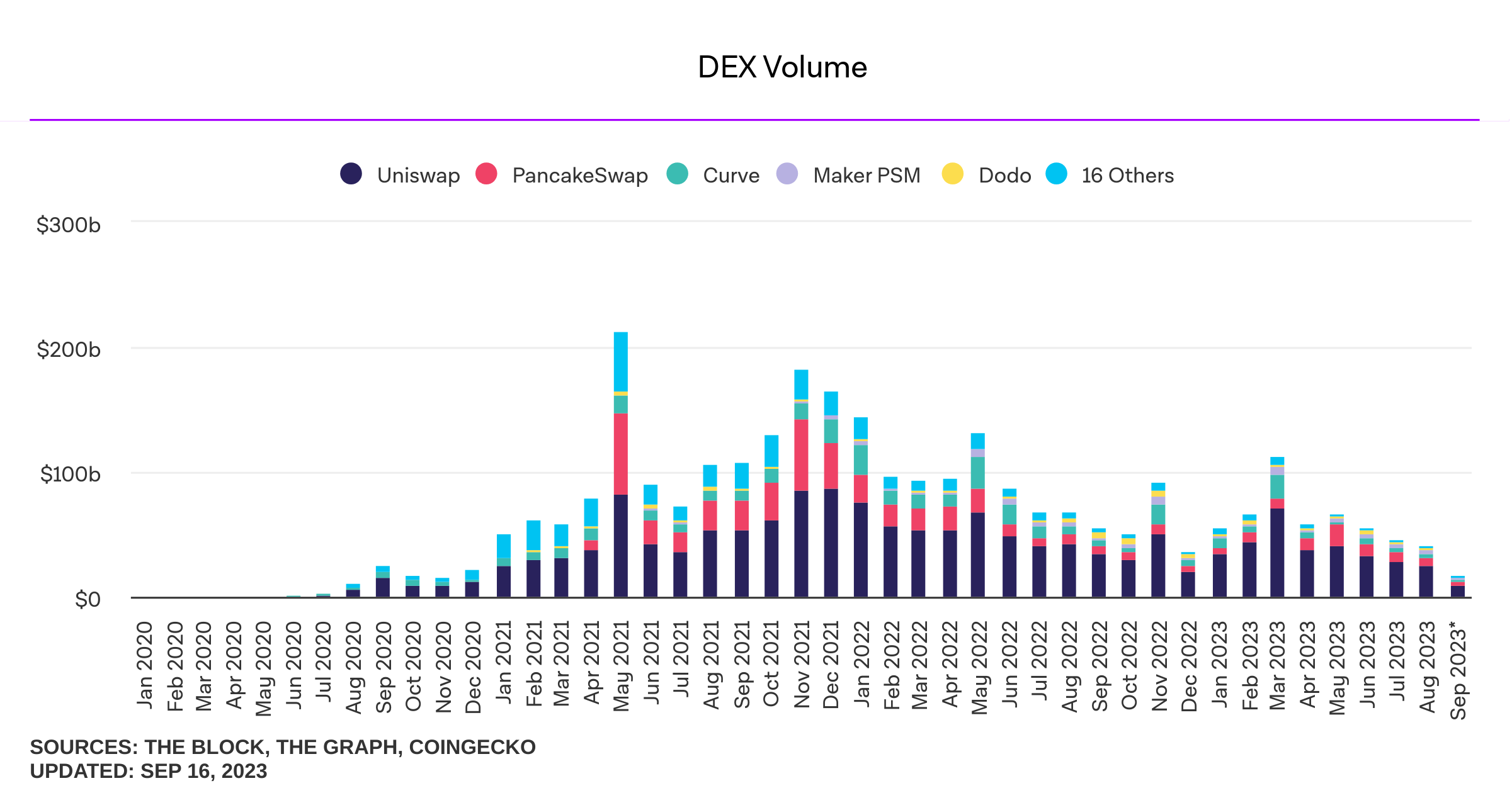

After capturing $66.5 billion in May, decentralized exchange (dex) trade volumes have fallen for four consecutive months, with August statistics reaching a 2023 low of $41.7 billion. Metrics for the first half of September do not show improvement, with decentralized exchange trade volumes at about $16.96 billion as of September 18, 2023.

Dex Volumes Nosedive 37% Post-May

Dex trade volumes have fallen significantly over the past four months. Data indicate that March saw the year’s highest dex trade volume at $112 billion. In April, volumes declined by 47.26% to $59.06 billion.

May experienced a 12.59% increase, with trade volumes rising to $66.5 billion; of that amount, Uniswap’s dex trades contributed $33.67 billion. Since May, however, dex trade volume has declined by 37.29%.

August data indicate dex trade volume at $41.7 billion, with $24.87 billion, or 59.64%, coming from Uniswap trades. Pancakeswap saw $6.76 billion in trades, while Curve Finance contributed $3.79 billion.

Those three dex protocols totaled $35.42 billion in August, making up 84.94% of the month’s global dex volumes. Although September isn’t finished, its dex volumes to date already appear lackluster.

As of September 18, 2023, the global dex trade volume stands at $16.96 billion. Approximately $10.27 billion of that total comes from Uniswap trades, about $3.14 billion from PancakeSwap, and $1.07 billion from Curve.

With only 12 days remaining in September, dex trade volumes might finish below August’s numbers. The data is further highlighted in a monthly crypto recap report by the digital asset manager Vaneck, which indicated a decline in August’s onchain economic activity tied to decentralized finance (defi).

“Decentralized exchange volume experienced a more severe decline,” wrote Matthew Sigel, Vaneck’s head of Digital Assets Research.

What do you think about the recent dex trade volume downturn? Do you expect a rebound any time soon? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/Kpx7JDl

Comments

Post a Comment