Binance and the U.S. Securities and Exchange Commission (SEC) struck a deal to avoid the freezing of the crypto exchange’s assets in the United States. Under an emergency relief secured by the regulator, Binance agreed to repatriate to the U.S. funds held on behalf of customers of its American subsidiary.

Binance US Users to Be Able to Withdraw Funds as Agreement With SEC Helps Avoid Asset Freeze

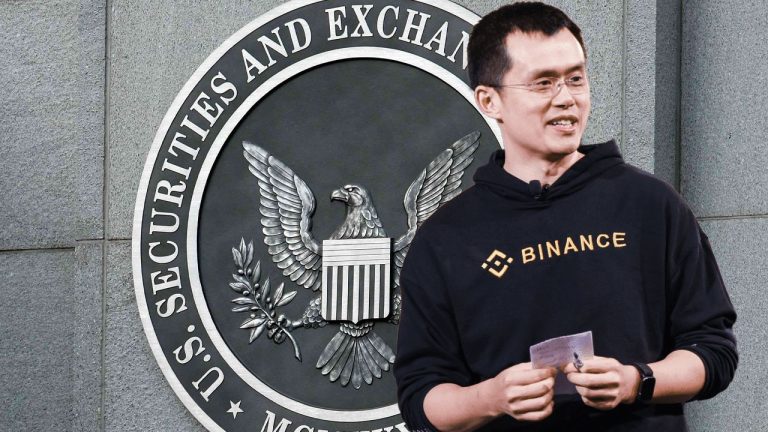

The U.S. securities regulator announced on Saturday it has secured an emergency relief in which all entities responsible for operating Binance US and the founder of the world’s largest crypto exchange, Changpeng Zhao (CZ), agreed to repatriate to the U.S. assets held for the benefit of customers of the American unit.

The order from the United States District Court for the District of Columbia helps ensure that Binance US users are permitted to withdraw their assets from the trading platform, the SEC emphasized. Also, the assets kept on Binance US will be protected and remain in the United States, the Commission assured in a press release.

The announcement comes after earlier reports, citing court filings, revealed that Binance and the SEC have reached an agreement on the matter. According to Coindesk and Reuters, only Binance US employees will have access to US customer funds under the deal, and not officials from Binance Holdings, the operator of the global trading platform.

The SEC sought a temporary restraining order for the assets of Binance’s US subsidiary, citing concerns over their safety, after it sued the cryptocurrency exchange for violating US securities laws. The regulator also accused Binance and its founder and chief executive of mishandling of customer funds and misleading investors.

Lawyers representing Binance asked the court to reject the SEC’s request, arguing that an asset freeze would amount to a “death penalty” for the U.S.-based entity. At a hearing in Washington on Tuesday, U.S. District Judge Amy Berman Jackson gave the sides an opportunity to work out a deal ensuring user funds are safe without crippling the crypto business.

Binance Required to Provide SEC With Oversight Over Business Expenses

The latest court order also prohibits defendants BAM Trading Services Inc. and BAM Management US Holdings, Inc. from spending corporate assets other than in the ordinary course of business, the SEC pointed out. The entities have been also required to provide the SEC with oversight over such expenses.

“Given that Changpeng Zhao and Binance have control of the platforms’ customers’ assets and have been able to commingle customer assets or divert customer assets as they please, as we have alleged, these prohibitions are essential to protecting investor assets,” its Director of the Division of Enforcement, Gurbir S. Grewal, was quoted as saying. He added:

Further, we ensured that U.S. customers will be able to withdraw their assets from the platform while we work to resolve the alleged underlying misconduct and hold Zhao and the Binance entities accountable for their alleged securities law violations.

is now required to maintain U.S. customer assets in the United States for the duration of the SEC litigation and to facilitate customer withdrawals. The court order prohibits BAM from transferring assets or funds or providing control over such, to Binance Holdings, CEO Changpeng Zhao, or their affiliates.

What are your thoughts on the agreement between Binance and the SEC? Share them in the comments section below.

from Bitcoin News https://ift.tt/iqA3EJy

Comments

Post a Comment