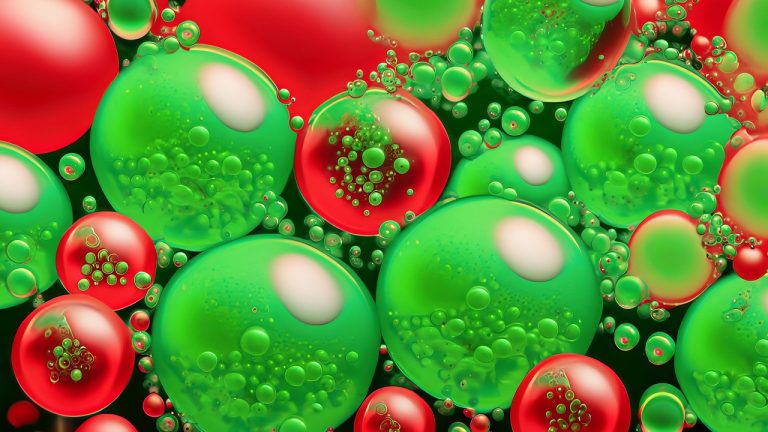

During the past week, crypto assets increased in value by 9.62%, rising from $1.10 trillion to the current $1.21 trillion. Apart from the listed stablecoins, the top 20 crypto assets by market capitalization all experienced gains this week, as $110 billion was injected into the crypto economy.

Crypto Market Surges, Rally Led by Pepe, Stacks, Bitcoin Cash

At the time of writing, the crypto economy stands at $1.21 trillion, following a 9.62% increase this week. Metrics indicate that bitcoin (BTC) gained 18.1%, while ethereum (ETH) rose by 12.5%.

However, numerous other digital assets experienced significantly larger gains, as evident from cryptobubbles.net’s weekly data. According to the data, BCH, XRD, PEPE, WOO, ZIL, and VET all recorded double-digit gains.

The meme coin pepe (PEPE) experienced a significant 65% increase this week, while bitcoin cash (BCH) jumped over 38%. Pepe led the pack in terms of gains, while stacks (STX) rose by more than 41% over the past seven days.

Conflux (CFX) saw a jump of 40.4%, and kaspa (KAS) gained 26% during the same period. On the other hand, digital currencies such as bittorrent (BTT), kucoin (KCS), terra luna classic (LUNC), and quant (QNT) faced losses ranging from 2.2% to 7.9% this week.

Friday’s leaders in terms of 24-hour stats include FTT, which is up more than 14%; VET, up over 11%; BSV, up more than 8%; LEO, also up more than 8%; ZIL, up 7.6%; and BCH, up more than 6%.

Although, today’s 24-hour losses are led by PEPE and STX. PEPE shed 5.5%, while STX lost 9.8% during the last day. Bitcoin dominance remains high at 48.2%, and ETH’s market dominance stands at 18.6%, according to coingecko.com’s current data.

The crypto rally is believed to be driven by institutional interest and the involvement of major traditional finance (tradfi) giants. In the past week and a half, several spot bitcoin exchange-traded funds (ETFs) were filed, and a crypto exchange backed by Charles Schwab, Citadel Securities, and Fidelity Digital Assets was recently launched.

However, despite the so-called institutional interest, the global trade volume of the crypto economy has been low, and a few crypto businesses are still exhibiting signs of financial weakness.

What are your predictions for the future of the crypto market? Which digital assets do you think will continue to outperform others in the coming weeks? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/zSwvs3M

Comments

Post a Comment