B2Broker Announces NDF Asset Class Addition Reduced Margin Requirements and Updates to PoP Liquidity Offering Package

PRESS RELEASE. B2Broker, a prominent global liquidity provider in the FX and crypto industry, proudly declares the inclusion of Non-Deliverable Forwards (NDFs) in its extensive range of liquidity offerings. This strategic expansion further strengthens the company’s commitment to furnishing comprehensive asset coverage and unparalleled risk management solutions for all B2Broker customers.

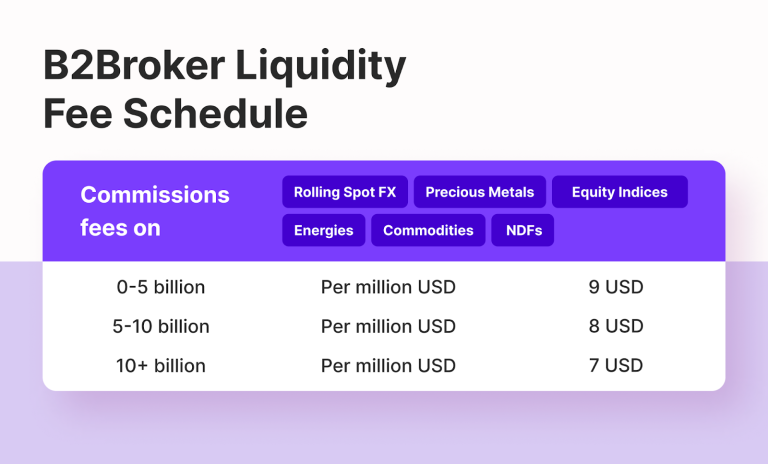

As a multi-asset liquidity provider, B2Broker supports all major asset classes, which include:

- Rolling Spot FX & Precious Metals

- Equity Indices

- Energies

- Commodities

- Crypto Derivatives/CFDs

- Single Stocks/CFDs

- ETFs

- NDFs

This accomplishment consolidates B2Broker’s leading position in the industry, demonstrating its steadfast commitment to meeting the diverse requirements of its clients.

NDFs At B2Broker

NDFs are critical financial instruments in international trade used to mitigate currency risk. They enable parties to offset potential losses resulting from fluctuations in exchange rates between two currencies. NDFs allow participants to swap the difference between a pre-agreed fixed exchange rate at the start of the contract and the current market exchange rate on a specified future date. NDFs are cash settlements, meaning they do not involve the actual exchange of the underlying currencies.

These instruments are particularly important in emerging markets where local currency forwards may not be feasible or available, making them effective tools for managing risk and offer companies a cost-effective approach to hedging against potential losses in cross-border transactions.

B2Broker offers a wide range of NDF currencies, providing customers the option to offset currency risk in various emerging markets. These NDF currencies include USD/BRL, USD/CLP, USD/COP, USD/IDR, USD/INR, USD/KRW, and USD/TWD.

Advantages Of B2Broker’s Innovative Product

B2Broker has designed NDFs based on the structure of Contracts For Differences (CFDs). Thus, unlike traditional NDFs, where settlements can take up to T+30 days, B2Broker’s clients can receive their settlements on the next business day through the CFD contracts. This innovation eliminates client settlement risks and expedites the entire process, ensuring optimal efficiency and peace of mind.

B2Broker’s dedication is further expressed through its commission rates, which are currently some of the lowest in the industry.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

from Bitcoin News https://ift.tt/KyTLeMh

Comments

Post a Comment