The Evolution of Investor Portfolios with Rollman Mining: Embracing Cryptocurrencies for Optimal Diversification

PRESS RELEASE. Tallinn, 20th June 2023 – Rollman Mining, as the financial landscape continues to evolve, investor portfolios must adapt to changing times. The rise of cryptocurrencies has captured the attention of financial experts and media outlets who suggest that allocating a portion of your portfolio to cryptocurrencies can enhance diversification and potentially boost returns. In this article, we will explore the concept of portfolio evolution and delve into why cryptocurrencies, as recommended by leading portfolio experts, should make up between 5% and 20% of your investment portfolio.

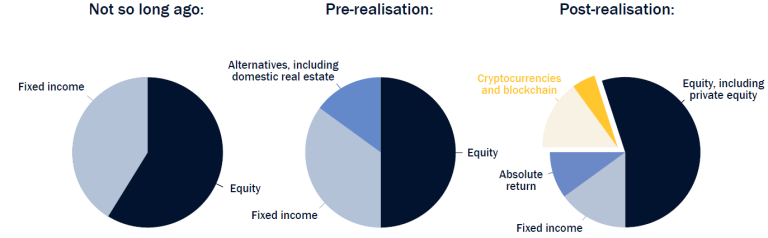

The evolution of investor portfolios? Pre and post-realisation

The Changing Landscape of Investor Portfolios

Traditionally, investor portfolios consisted of a mix of stocks, bonds, and cash. However, as technological advancements and new asset classes emerge, the need to adapt and diversify becomes increasingly vital. Leading portfolio experts, have recognized the potential benefits of including cryptocurrencies in investment portfolios. This acknowledgment reflects the shifting mindset among investors, as they seek to harness the advantages offered by this innovative asset class.

Understanding the Significance of Cryptocurrencies

Cryptocurrencies, such as Bitcoin and Ethereum, have gained significant traction and mainstream recognition in recent years. These digital assets operate on blockchain technology, offering decentralized and secure transactions. The potential for high returns and the ability to hedge against traditional market risks have made cryptocurrencies an appealing investment option.

Enhancing Diversification with Cryptocurrencies

Diversification is a cornerstone of sound investment strategy, aiming to reduce risk and maximize returns. Many leading portfolio experts advocate for including cryptocurrencies in portfolios to achieve optimal diversification. By adding cryptocurrencies to a mix of traditional assets, such as stocks and bonds, investors can access an asset class with low correlation to the broader market. This low correlation provides a potential hedge against market volatility and can help smooth out the overall performance of the portfolio.

Capturing the Growth Potential

Cryptocurrencies have demonstrated remarkable growth potential, with substantial returns generated over the past decade. While this market is known for its volatility, the potential rewards can be significant for those who embrace it wisely. Leading portfolio experts recognize this growth potential and recommend allocating a portion of your portfolio to cryptocurrencies as a means to capture these opportunities. By doing so, investors position themselves to benefit from the innovative technologies and disruptive potential of blockchain-based assets.

Mitigating Risk with a Balanced Approach

While cryptocurrencies offer exciting growth prospects, it’s important to approach their inclusion in a portfolio with a balanced perspective. An allocation between 5% and 20% to cryptocurrencies, allowing investors to participate in the potential upside while still maintaining a diversified portfolio. This balanced approach helps mitigate the risks associated with the volatility inherent in the cryptocurrency market.

Staying Informed and Educated

Investing in cryptocurrencies requires a solid understanding of the market dynamics and associated risks. Leading portfolio experts emphasize the importance of staying informed and educated about this evolving asset class. By conducting thorough research, engaging with reputable sources, and consulting with financial advisors, investors can make informed decisions and navigate the cryptocurrency market with confidence.

The Future of Finance: Embracing Digital Transformation

The inclusion of cryptocurrencies in investment portfolios goes beyond mere diversification. It reflects a broader trend of embracing digital transformation in the financial industry. As blockchain technology and cryptocurrencies continue to mature, they have the potential to disrupt various sectors, including finance, supply chain management, and more. By allocating a portion of your portfolio to cryptocurrencies, you position yourself at the forefront of this digital revolution, embracing the future of finance and capitalizing on the transformative power of innovative technologies.

Thesis – the case for traditional and alternative

We believe that adding this new alternative investment to a well-diversified traditional portfolio when actively managed will improve the benefits of diversification at any level because a portfolio with alternative assets tends to have a lower risk for a given level of return than the benchmark portfolio consisting solely of mega-cap stocks and bonds. A portfolio with low-correlated assets is an efficient way to hedge against market volatility and provides a higher return in the short and long term.

Diversification plays an indispensable role in a portfolio’s construction. It helps investors allocate capital in a way that is limiting the exposure to a single asset’s risk, unsystematic risk. The rationale behind this risk management strategy is that a well-diversified portfolio consisting of low-correlated multifarious assets will generate a long-term higher return with mitigating unsystematic risk. In general, low-correlated assets in a portfolio are an efficient way to hedge against market volatility and provides a higher return in the long term.

The case for crypto and blockchain strategies

Schopenhauer defines the three stages of any revolution as Ridiculous, Frightening and then Obvious. The nascent crypto and blockchain ecosystem is in its Spring, burgeoning at a brisk pace, and now exhibits characteristics of all three stages. We expect disruption in most industries, with a revolution for those dealing in transfer, storage, and accretion of value. A multi-trillion-dollar ecosystem will likely be built with cryptocurrencies and on the blockchain. Growth and system inefficiencies abound and can be harvested via many high yielding strategies. Better yet, these returns show manageable cross-correlations and negligible correlations with traditional assets, allowing the creation of portfolios with superior risk/return characteristics. Yes, the blockchain ecosystem is young, volatile, and contains specific threats. Nevertheless, this blockchain ecosystem holds fantastic potential for the long view investor. The Rollman Mining strategies seek to capture these returns in the most conservative way by making this revolution of passive income available to everyone.

About Rollman Mining

Rollman Mining is a prominent firm specializing in Bitcoin mining, hosting, and management. With a Retail and Institutional division, Rollman Mining delivers exceptional Bitcoin mining solutions at competitive rates. The company was founded by a group of seasoned professionals in finance, trading, engineering, data science, operations, and risk management. This experienced team has a proven track record in the industry and previously established Rollman Capital, which is recognized as Luxembourg’s first institutional asset manager, offering diverse investment opportunities across stocks, forex, commodities, indices, cryptocurrencies, and their passive income avenue, Lending.

About Victor R. Ch. Rollman

Victor is currently the CEO of Rollman Mining, a Bitcoin mining firm specialised in accessible institutional grade Bitcoin mining and Rollman Capital, a Luxembourg based Hedge Fund. He has been educating and advising traditional investment professionals about cryptocurrency and blockchain investment technologies. Prior to that, he was managing a multi- strategy portfolio, including stocks, forex, commodities, indices and cryptocurrencies. Victor was also involved in a wide range of industries as a serial entrepreneur, from real-estate projects in Belgium to the electricity market in the Netherlands. With over 20 years of investment experience analysing global financial markets, 12 years in early-stage ventures, and 10 years within the crypto and blockchain space, Victor’s ability to create and oversee high return portfolios in the €50m to €100m range is top-tier.

Find out more about Rollman Mining:

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

from Bitcoin News https://ift.tt/oaInSkZ

Comments

Post a Comment