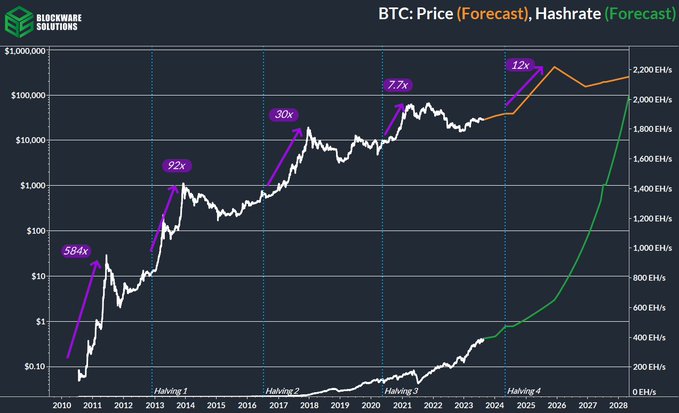

The highly anticipated 2024 bitcoin halving could spark a meteoric price rise, potentially driving its value to a staggering $400,000, suggests an analysis by Blockware Solutions. The forecasted supply trim in 2024 might ignite an explosive demand for bitcoin. The report highlights how a dynamic duo — a dip in sell-off pressures and a burgeoning buying spree — might set the stage for bitcoin’s most monumental cycle price surge ever.

Blockware Solutions: ‘$400K per Bitcoin Is a Reasonable Expectation Due to the $2B Halving Supply Shock’

Blockware Solutions’ latest report posits that post the impending halving, bitcoin’s price might catapult, marking an astounding 1,250% increase from current levels. Delving into historical data, the report emphasizes that bitcoin halvings have consistently spurred bullish tides for its price. The impending dip in mining rewards, coupled with a dwindling supply on exchanges, might set the stage for an unprecedented price surge, even outpacing prior halving cycles.

In terms of sheer numbers, Blockware predicts the halving will carve out over $2 billion in annual sales from miners. If bitcoin hovers around the $35,000 mark pre-halving, a subsequent 12-fold leap could translate to a price tag of $420,000 per bitcoin. The potentiality of matching gold’s whopping $12 trillion market cap is also highlighted.

“Assuming a price of $35,000 at the date of the halving, a $400,000 cycle top would break the trend of diminishing returns; a reasonable expectation due to the $2B halving supply shock and increasing scarcity of liquid BTC supply on exchanges,” the research elaborates. Bitcoin’s unequivocal issuance timeline implies that demand fluctuations aren’t offset by supply responses, indicating post-halving demand surges might be colossal.

The report also underlines that post-halving, miner retreats will likely shift a more significant chunk of bitcoin supply to long-term enthusiasts, bolstering profitability for adept miners, thereby trimming sell-off pressures. While the forecasted effects of the 2024 halving echo those of its predecessors, this round might have a more bullish undertone, amplified by dwindling exchange reserves and investors’ early moves.

“There will be less BTC available than previous cycles, the first halving this has ever occurred,” the report comments on the receding exchange stockpiles.

Bitcoin’s unique traits — its fixed supply, decentralization, and unwavering transparency — are pinpointed as the driving forces behind its soaring adoption and price trajectory. The guaranteed reduction in miner sales post-2024 halving further solidifies bitcoin’s bullish narrative. “Despite the block subsidy halvings, mining will likely continue to be the best way to accumulate large amounts of BTC in the future,” conclude the researchers at Blockware Solutions.

What do you think about the analysis Blockware Solutions published? Do you think bitcoin can reach $400K after the 2024 halving? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/CThZFBD

Comments

Post a Comment