In the rapidly evolving world of cryptocurrencies, stablecoins have emerged as a beacon of stability amidst the volatility of digital assets like Bitcoin and Ethereum. Stablecoins are digital currencies anchored to a diversified asset, such as fiat currency or different commodities like gold. One of the most promising developments in the stablecoin market is the unique Edelcoin.

Edelcoin: A Unique Stablecoin

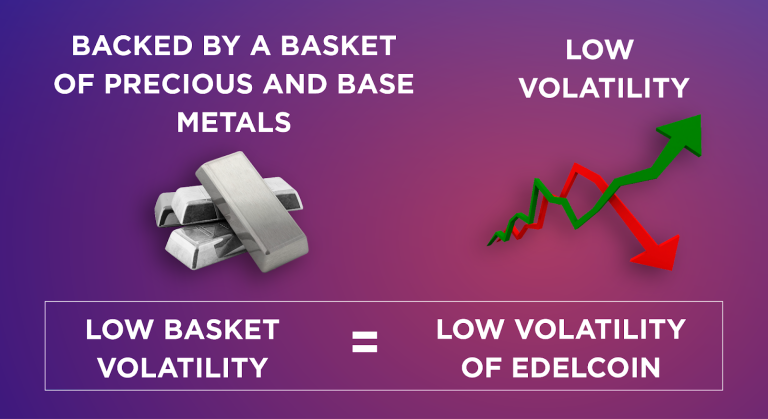

Enter Edelcoin, a stablecoin backed by a basket of precious and base metals which are used across various industries, including medicine, medical research, electronics, aerospace, military, energy, telecommunications, and navigation. These metals include Copper Isotope, Nickel Wire (NP1, NP2), and Caesium 133, each with unique applications and supply circumstances.

Benefits of Edelcoin

Edelcoin is backed by these metals, offering benefits such as low volatility due to the real nature of the underlying assets. The basket nature of the underlying metals further reinforces the low volatility of Edelcoin.

However, it is essential to note that past price development is not a guide for future price developments.

Here are a few use cases for the metals backing up each EDLC.

Applications of the Backing Metals

- Copper Isotopes: Copper isotopes, notably Copper-63 and Copper-65, are widely used in medicine, biochemistry, and as tracers in chemical and physical experiments. They are also essential in the production of radiopharmaceuticals and for diagnostic procedures in nuclear medicine. The supply of these isotopes involves intricate and costly extraction and purification processes.

- Nickel Wire (NP1, NP2): High-purity NP1 and NP2 grade Nickel wire is extensively used in electronics, aerospace, and energy industries due to its high melting point, resistance to oxidation and corrosion, and exceptional thermal and electrical properties. Geopolitical risks characterize the supply of this metal.

- Caesium 133: Caesium 133 is primarily used in atomic clocks, the most accurate time and frequency standards known. Its applications also extend to telecommunication and global navigation satellite systems. The supply of this metal is characterized by its scarcity, as it is one of the rarest elements on Earth.

Vision

Edelcoin is built for now, and the future, and it is reflected in its vision.

The vision of Edelcoin revolves around the sustainable utilization of the Wealth of the Earth, leveraging the power of blockchain technology. Throughout history, the means of exchanging value as a form of payment have undergone multiple transformations. It is now time for another paradigm shift that combines the best elements of the past and the future, offering a stable, reliable, and cost-effective alternative to existing payment methods and stablecoins.

Edelcoin’s vision is to bridge the gap between the traditional financial sector and the decentralized financial world. By harnessing the advantages and expertise of the old world and the innovation and growth potential of new technologies, we aim to enhance security and restore trust in the market.

Mission of Edelcoin

Edelcoins’ mission is to bring back a stable, asset-backed means of payment and store of value as a digital instrument with the opportunities of DeFi.

The mission is centered around sustainable value creation across the entire lifecycle. It aims to establish and reintroduce a stable payment method backed by real-world assets. Through tokenizing commodities, EDLC unlocks unprecedented possibilities for revolutionary use cases within the decentralized finance world.

Edelcoin is committed to pursuing its mission within a regulatory-compliant Swiss framework, setting new standards for corporate governance in the future of the decentralized economy. The goal is to position Edelcoin as the leading stable payment token and become the industry benchmark.

Whitepaper of Edelcoin

The Edelcoin whitepaper is a testament to the project’s commitment to transparency, innovation, and the sustainable use of Earth’s resources. It meticulously outlines the technical and economic foundations of the Edelverse. At its core, the whitepaper emphasizes the importance of a stablecoin backed by valuable assets, ensuring that each Edelcoin is over-collateralized by 25%. This approach not only guarantees the coin’s stability but also its resilience against economic downturns. The whitepaper further delves into the tokenization process and the rigorous KYC and AML checks in Switzerland for metal owners wishing to tokenize them. With a clear roadmap, the whitepaper paints a promising picture of Edelcoin’s future, positioning it as a frontrunner in the next generation of stablecoins. The document is a must-read for anyone keen on understanding the intricacies of a metal-backed digital currency and the future it envisions for the decentralized economy.

Advantages of Edelcoin

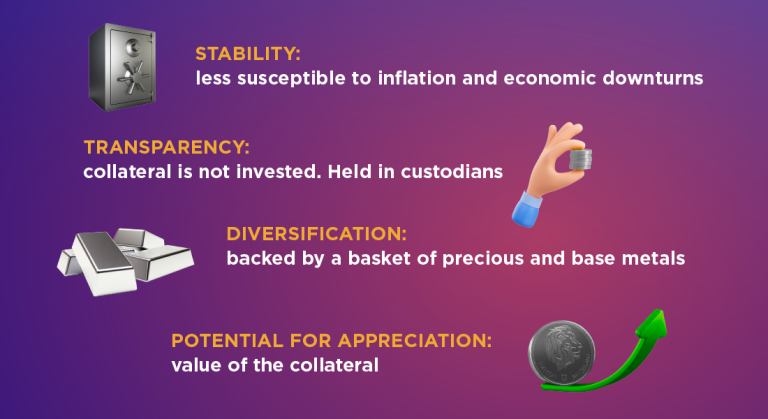

Stability: A stablecoin backed by a basket of precious and base metals like Edelcoin are less susceptible to inflation and economic downturns than fiat-backed stablecoins. Precious metals have historically held their value over time, making them a reliable store of wealth.

Transparency: Edelcoin provides transparent collateral peace of mind. The collateral pre-exists the minting of the coins, is not invested, and is held in certified high-security custodians. Each coin is associated with an identifiable fraction of the certified and disclosed collateral of the basket.

Diversification: Edelcoin is backed by a basket of precious and base metals, providing a diversified and balanced mix that mitigates price volatility.

Potential for Appreciation: The value of Edelcoin is driven by the value of the collateral, which may appreciate over time due to the growing demand for those metals in various industries.

Contribution to Eco-Friendly Initiatives: By using Edelcoin, users contribute to eco-friendly and more efficient mining (nano-mining) procedures and charitable initiatives through the contribution of the tokenization proceeds.

Edelverse

Edelcoin is being adopted in the marketplace. Use cases as payment tokens are numerous and may include adoption in wallets for peer-to-peer transactions, embedding in lending protocols, but also acceptance as a means of payment in goods and services transactions – very much as numerous stores worldwide accept bitcoin as a means of payment. We are happy to see that Edelcoin can serve as a means of payment to buy gold and silver coins at our partner boutique.

Edelcoin’s Milestone

Edelcoin has recently minted its first batch of 5.5 billion tokens, marking a significant milestone in its journey to provide a superior stablecoin for the crypto market. For the ease of users, it’s important to note that 1 EDLC was set equivalent to 1 USD for the launch. With its unique backing of precious and base metals, Edelcoin offers a stable and secure alternative for users looking for a reliable digital currency.

Edelcoin FAQ Highlights

- Edelcoin is a unique stablecoin backed by a basket of precious and base metals.

- Owning Edelcoins means you co-own the metals backing them.

- Its value is tied to the value of its metal reserves. Historically, these metals have shown low volatility compared to fiat currencies.

- Edelcoin is well-suited for trading crypto assets on the blockchain.

- Coins are minted following the tokenization of existing metal reserves. Edelcoin AG subjects metal owners wishing to tokenize these metals to rigorous KYC and AML checks in Switzerland.

- EDLC serves as both a means of payment and a store of value.

- Edelcoin is minted in Switzerland by Edelcoin AG.

- Edelcoin AG is fully compliant with Swiss legislation. It is a member of the FINMA-recognised Self Regulatory Organisation “VQF” for ensuring compliance with AML and CTF legislation.

Listings on Exchanges

Edelcoin is currently listed on cryptocurrency exchanges, such as xt.com and probit.com, making it easily accessible for trading and investment. More exchanges are coming in the near future.

The Future of Metal-Backed Stablecoins

The advantages of metal-backed stablecoins are numerous and have been recognized by experts in the field. These stablecoins are considered the future of crypto stablecoins for several reasons, including inherent value, hedge against inflation, global acceptance, transparency, accountability, and diversification.

Conclusion

Edelcoin represents a significant advancement in the world of stablecoins, offering a unique and innovative approach to digital currency backed by a basket of precious and base metals.

Its low volatility, transparency, diversification, potential for appreciation, and contribution to eco-friendly initiatives make it an attractive option for users seeking a reliable digital currency. As the demand for stablecoins continues to grow, Edelcoin is well-positioned to become a leading player in the stablecoin market. Its recent milestone of minting 5.5 billion tokens and its listings on cryptocurrency exchanges like xt.com and probit.com further solidify its presence in the crypto market. With its unique backing, regulatory compliance, and commitment to transparency, Edelcoin is poised to revolutionize the stablecoin landscape and provide a trusted and innovative solution for the crypto community.

Follow us on Socials: https://linktr.ee/edelcoin

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

from Bitcoin News https://ift.tt/v9OFwdK

Comments

Post a Comment