In less than a month, despite a downturn in cryptocurrency markets, over 680,000 ethereum (ETH) has been added to liquid staking derivatives protocols. Lido Finance, the leading liquid staking platform, experienced a supply increase of 5.94%, surging from 7.91 million to 8.38 million ETH since July 29.

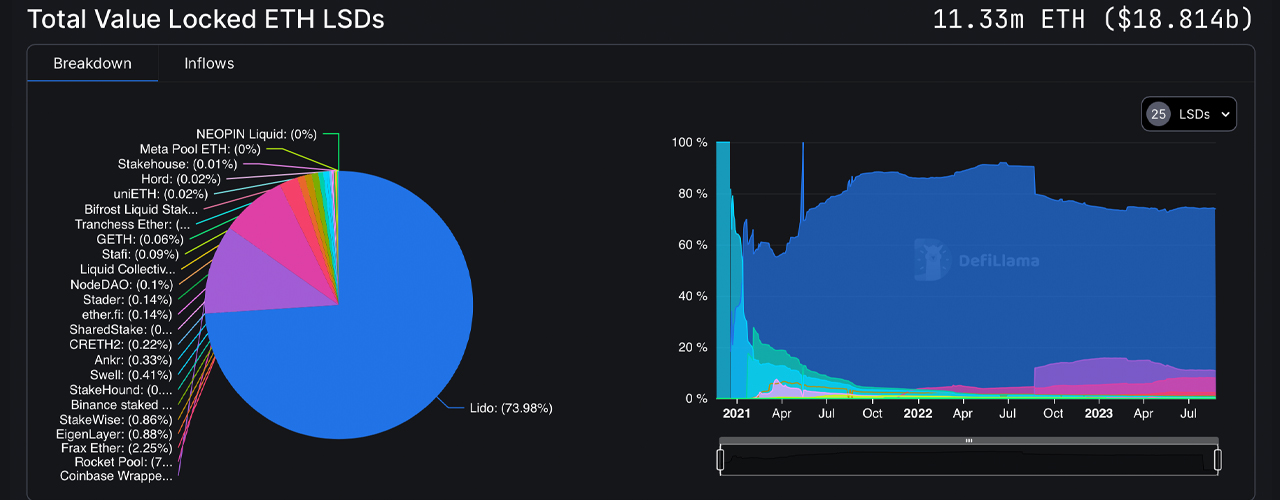

Ether Held in Liquid Staking Jumps From 10.65 Million to 11.33 Million in Less Than a Month

Over the previous 28 days, a collection of 25 liquid staking derivatives protocols witnessed more than 680,000 ETH added. On July 29, 2023, liquid staking applications held about 10.65 million ETH; today, this figure has climbed to roughly 11.33 million. Lido maintains a dominant 73.98% market share with its 8.38 million ETH stake following the near-6% increase.

Among the total of over 680,000 ETH contributed during the past 28 days, Lido received an influx of about 470,000 ETH. Back on July 29, Coinbase’s liquid staking derivative product held approximately 1.17 million ether; today, it stands at around 1.22 million. Rocket Pool experienced an increase from holding about 857,967 ETH to now possessing about 901,072 ETH within the same time frame. Lido, Coinbase, and Rocket Pool lead the pack followed by Frax Ether (approximately 254,692 ETH) and Eigenlayer’s liquid staking platform (roughly 100,025 ETH).

Last month witnessed Binance Pool achieving a significant rise of nearly 29.2%, reaching around 92,824 ETH in its stakeholding over a span of thirty days. Currently holding around 93,504 ETH suggests a meager 0.73% rise in its stake in the previous four-week period. Liquid staking tokens have notably gained popularity over the past couple of years — a stark contrast from just two such protocols existing at the beginning of January 2021.

Liquid Staking Accounts for Nearly 10% of All the Ether Circulating Today

Employing liquid staking protocols confers various benefits. Users avoid technical hurdles in setting up and managing validator nodes, while also facing reduced risk from penalties or errors due to mismanagement. Furthermore, liquid staking allows immediate liquidity via staked tokens, making participation accessible to users who don’t want their assets locked. This inclusive feature simplifies the staking process for all.

Nevertheless, it is important to note that liquid staking tokens do carry risks. A primary risk linked with liquid staking is de-pegging — when the locked token and its derivative have differing values. Decentralized exchanges use arbitrage mechanisms to maintain a peg for liquid staking tokens. However, if the total value locked (TVL) in liquidity pools drops steeply, this can disrupt arbitrage incentives and cause the token to lose its peg.

Should the TVL in liquidity pools deplete, the token risks losing its peg, leading to significant slippage during asset swaps. Yet, the allure of liquid staking has remained strong for decentralized finance enthusiasts, who persistently contribute ether to these liquid staking derivatives platforms. Statistics show that the 11.33 million ether locked today makes up 9.42% of the 120.21 million circulating ethereum in existence.

What do you think about the 680,000 ether added to liquid staking derivatives protocols over the last 28 days? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/RFV9evJ

Comments

Post a Comment