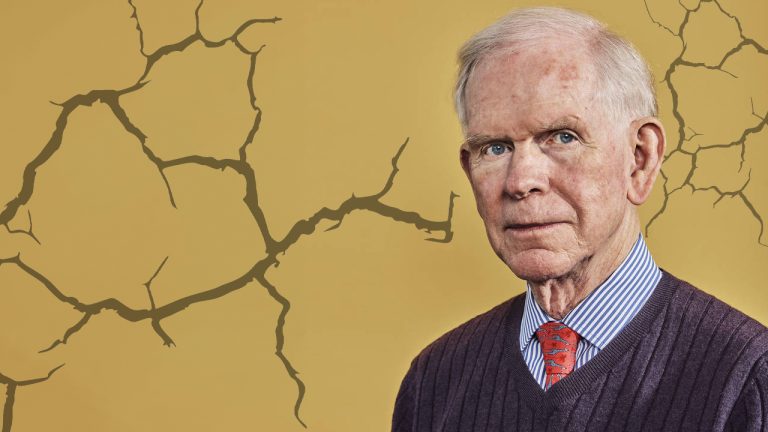

A significant portion of investors and financial organizations surmise that the U.S. could avert a recession, but Jeremy Grantham, the co-founder of investment firm Grantham Mayo Van Otterloo (GMO), deems it inescapable. Grantham contends that the Federal Reserve’s optimistic prognosis is “almost guaranteed to be wrong.”

U.S. Bound for Recession, Says Investment Titan Grantham

Esteemed investor Jeremy Grantham, who accurately foresaw the dotcom crash of 2001 and the Global Financial Crisis of 2008, has been forecasting an economic decline in the U.S. since 2021. Reportedly managing about $65 billion in assets, GMO’s Grantham shared his thoughts on the U.S. economy during a Bloomberg interview on Thursday.

Grantham asserts that America “will have a recession running perhaps deep into next year and an accompanying decline in stock prices.” He also maintains that the U.S. Federal Reserve’s predictions are inaccurate. In a tongue-in-cheek remark, Grantham quipped: “[T]he Fed’s record on these things is wonderful — It’s almost guaranteed to be wrong.” The investment tycoon elaborated:

[The Fed has] never called a recession, particularly not the ones following the great bubbles.

Grantham has consistently expressed similar sentiments, warning in September 2022 that the economy appeared “more dangerous” than the chaos surrounding the 2008 crisis. Speaking with Bloomberg on Thursday, Grantham argued that the Fed would neither acknowledge nor accept responsibility for the impending downturn.

“They took credit for the beneficial effect of higher asset prices on the economy,” Grantham remarked. “But they have never claimed credit for the deflationary effect of asset prices breaking—and they always do.”

Other market analysts like Peter Schiff, Robert Kiyosaki, Michael Burry, and Danielle DiMartino Booth concur with Grantham’s perspective. The GMO co-founder emphasized his belief that inflation will persist and fail to reach the Fed’s 2% goal.

“I suspect inflation will never be as low as average for the last 10 years,” Grantham divulged to Bloomberg. “We have reentered a period of moderately higher inflation and therefore moderately higher interest rates. And in the end, life is simple: low rates push up asset prices, higher rates push asset prices down.”

Despite the predictions of Grantham and others who forecast a U.S. downturn, the U.S. is outpacing other G7 nations in terms of recovery. This means the U.S. economy has had the strongest recovery, as measured by gross domestic product (GDP), within the G7.

What do you think about Grantham’s forecast? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/pWdtTiG

Comments

Post a Comment